🏠 Your First Home Mortgage, Secured with Confidence.

The Wealth Architect’s Guide for First-Time Buyers

TL;DR - What You’ll Learn

Buying your first home isn’t just a mortgage decision — it’s your first financial blueprint.

Learn how to prepare, budget, and choose the right mortgage with independent, whole-of-market advice.

Understand the hidden costs and steps to buying a home in the UK.

Discover how to protect your new investment and set yourself up for long-term wealth.

Download or book a free consultation to start designing your first-time buyer plan.

Introduction: Building Your First Financial Foundation

Buying your first home is one of life’s biggest milestones - but also one of its also full of questions and confusion. Between rates, deposits, and lender jargon, it’s easy to feel overwhelmed.

At Turkington Davis, we help first-time buyers take that step with clarity and confidence. As Wealth Architects, our role is to design a clear financial blueprint - one that supports your home purchase today and your wealth journey for tomorrow.

In this post, we’ll explain how to prepare financially, what lenders look for, and how independent advice can make the difference between feeling stretched and feeling secure.

1️⃣ Understanding What You Can Afford

The first step isn’t choosing a mortgage - it’s understanding your overall affordability.

Key factors lenders consider:

Income & employment: Regular income, bonuses, and contract stability.

Credit history: Missed payments or debts can affect approval.

Existing commitments: Credit cards, loans, childcare, or car finance.

Deposit size: Typically 5–10%, though larger deposits can unlock better rates.

💡 Pro tip: Before applying, check your credit score and review your budget to see what you can comfortably afford - not just what the lender says you can borrow - or call us, and we will support you work it out.

🔗 Read more: MoneyHelper – Buying a Home

2️⃣ The First-Time Buyer Mortgage Landscape in 2025

The mortgage market moves fast. Interest rates, lender criteria, and government schemes are constantly evolving.

Current options include:

Fixed-rate mortgages: Peace of mind with consistent payments.

Tracker or variable rates: Can save money if rates fall.

Guarantor or family-assisted mortgages: Ideal if parents can help with security.

Shared ownership or 95% LTV options: For those with smaller deposits.

As independent, whole-of-market advisers, Turkington Davis isn’t tied to any lender — we scan the full market to find the most suitable fit for your goals, not theirs.

📈 For reference: Bank of England – Bank Rate History

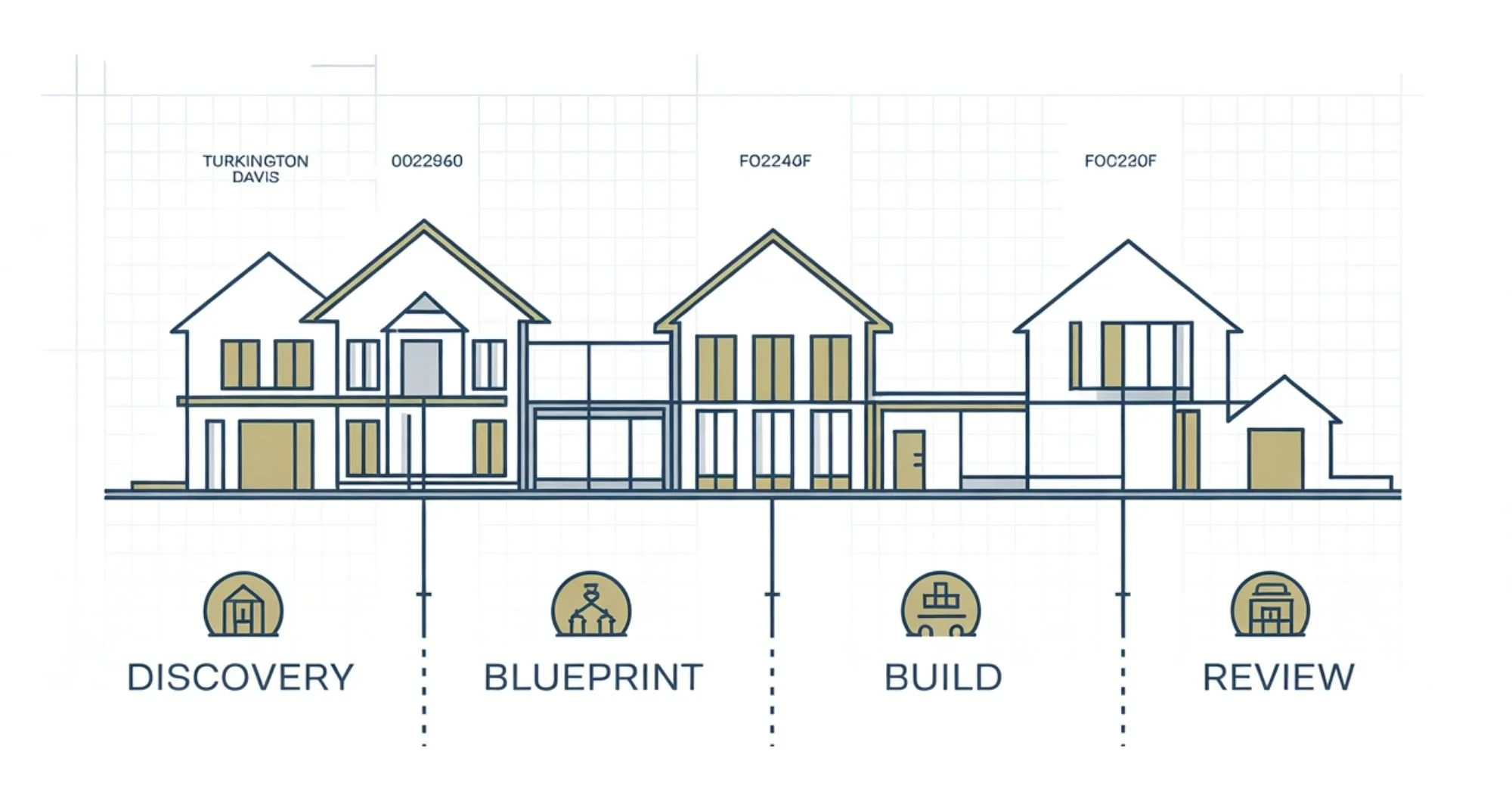

3️⃣ Designing Your Home-buying Blueprint

Every property purchase should form part of a bigger financial plan. It’s often the largest financial commitment you’ll ever make, so it’s important to consider your future plans, goals, and vision for the next 5–10 years. Doing so helps to create a clear blueprint that will support you in getting there. That’s why we combine mortgage advice with a wider financial strategy - to ensure every decision supports your long-term goals.

Your first home can be the foundation of your long-term wealth.

| Step | Focus | Why It Matters |

|---|---|---|

| Discovery | Understanding your goals, financial situation, and vision. | Ensures the mortgage fits your life, not the other way around. |

| Blueprint | Creating a plan for deposit, borrowing, protection, and the future. | Balances ambition with affordability, creating a blueprint as a guide. |

| Build | Securing the mortgage and protection policies. | Gives structure and stability. |

| Review | Revisiting after 2–5 years. | Keeps your plan aligned with new goals and market shifts. |

💬 Our goal isn’t just to get you into a house - it’s to help you build financial confidence for life.

4️⃣ Common Hidden Costs First-Time Buyers Miss

Even with a good deposit, extra costs can catch you off guard:

Solicitor and conveyancing fees

Valuation or survey fees

Mortgage arrangement fees

Stamp Duty (if applicable)

Moving and furnishing costs

Life and income protection cover

By planning these early, your budget remains realistic - and your stress lower.

🔗 Useful resource: MoneyHelper - Fees & costs when buying or selling your home

5️⃣ Protecting Your New Investment

Buying your first home is a major commitment - and protecting it matters.

We help clients structure affordable protection to safeguard their new lifestyle:

Life insurance to cover the mortgage balance.

Income protection to replace earnings if you can’t work.

Critical illness cover to protect against the unexpected.

Protection isn’t about fear - it’s about confidence. It ensures the home you’ve built remains yours, even when life changes.

6️⃣ Why Independent Advice Makes a Difference

Unlike high street banks, we have access to the entire mortgage market - including exclusive deals not available directly.

But the real value lies in our approach:

✅ Whole-of-market access

✅ Personalised recommendations

✅ Guidance from application to completion

✅ Support for protection, pensions, and long-term planning

It’s a partnership, not a transaction.

FAQ: First-Time Buyer Mortgages (2025)

Clear, practical answers to help you take your first step with confidence.

How much deposit do I need to buy my first home?

Most lenders require a minimum deposit of 5%, though a larger deposit — around 10–15% — can unlock better interest rates and a wider choice of products. Your adviser can help you understand how different deposit levels affect affordability and monthly payments.

How long does the mortgage process take?

On average, it takes 6–10 weeks from mortgage application to completion. The timeline can vary depending on your solicitor, the lender’s assessment process, and how quickly documents are supplied. At Turkington Davis, we guide clients through every stage to keep the process on track.

Can I get a mortgage if I’m self-employed?

Yes — self-employed buyers can absolutely secure mortgages. Most lenders will want to see 1–2 years of trading history, accounts, or tax returns. Independent advisers like Turkington Davis can access lenders who specialise in complex income structures. Learn more about self-employed mortgages here.

Should I choose a fixed or variable mortgage rate?

It depends on your circumstances and future plans. A fixed-rate mortgage offers stability and peace of mind with consistent payments. A variable or tracker rate can save money when interest rates fall but carries more risk. We help you weigh the pros and cons as part of your personal financial blueprint.

How do I know what I can afford?

Our advisers can assess your income, spending, and existing commitments to create a realistic affordability plan — not just what you can borrow, but what fits your lifestyle. Start by reviewing our First-Time Buyer Mortgages guide for useful tips and preparation steps.

What extra costs should I budget for as a first-time buyer?

Beyond your deposit, remember to budget for solicitor fees, valuation or survey costs, mortgage arrangement fees, removals, and home insurance. It’s also wise to consider life or income protection cover to safeguard your new home and income.

Do first-time buyers still get any help from the government?

While the Help to Buy scheme has ended, alternatives such as Shared Ownership, Lifetime ISAs, and regional first-home initiatives can help boost deposits or reduce monthly costs. Our advisers stay up to date with available options and can guide you through what’s open to you.

Closing Section: Start Designing Your First Home Plan

Buying your first home is exciting - but it’s also the foundation of your financial future.

At Turkington Davis, we’ll help you design the blueprint that gets you the keys today and keeps your finances strong for tomorrow.

👉 Book your free consultation to start your journey as a first-time buyer with clarity and confidence.

Your home may be repossessed if you do not keep up repayments on your mortgage.

References & Further Reading

- • Bank of England – Bank Rate History

- • Office for National Statistics – Inflation and Price Indices

- • MoneyHelper – Buying a Home

- • MoneyHelper – What Is Income Protection Insurance?

- • MoneyHelper – Building Your Retirement Pot

- • GOV.UK – Individual Savings Accounts (ISA)

- • GOV.UK – Selling or Closing Your Business

- • Financial Conduct Authority – Firm Register